Pre-open:

I had finished the EOD 7.3.2012 in following manner:

An analysis of sw5 of (v) , from 5382-5171 can give us some clue.

By the labels shown above , one can argue that a breach of 5244 would confirm the end of wave 5382-5171 as its (iv) would get breached. But this (iv) can also be labelled as an Expanded Flat as shown below:

And then from around 5265 ,we may see a sharp move down to sub-5171.

Now lets examine the above probablity in detail.

While a=5184-5243.55=59.55 was a clear 3 wave form, was b=5243.55-5171.6 a 3 wave form?

If yes,then above labels are valid. If no,then I would call the downmove over at 5171.6

So pulled out 30 sec charts to find out how waves have fanned out from 5243.55 onwards:

But here also fractals were out of permitted proportions.

So by EOD 7.3.12, status was fluid and the opening moves on 9.3.12 only shall define the future wave pattern.

So what should be our guiding light?

The labels shown below support the probability of Nifty going below 5171 once again.

.png)

But once above165% of a(=5184-5243.55=59.55) i.e. 5171.6+98.25=5270, this probabilty would become invalid.

So a tick above 5170 should become our guiding light to declare that first set of 5 waves from 5629 downwards has indeed ended at 5171 and buy at dips for targets 5460-5530 is called for.

And till this tick above 5270 does not take place,probability of once again going below 5171 should be considered very much alive.

How have we opened?

Opening above 5270 means short term bottom found at 5171.

Now we shall retrace 5629-5171=458 by 50-61%

And this upmove is likely to be a 3 wave form.

11.00AM

Time to book profit in longs and wait for the dips to go long again.

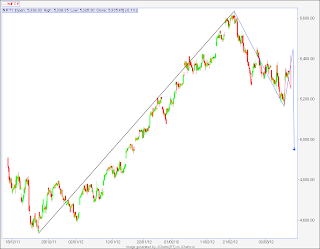

And what the trendlines are saying:

A visit to sub-5300 is definitely due.

1.30 PM

2.00 PM

Now most likely to test day's high,before starting down for a deeper corrective.

BE READY FOR DEEPER CORRECTIVE.

Below 5320,short for a gain of 80 points. Stop loss at day's high.

3.00 PM

Short below 5326. SL 5343

5326 not breached as yet.(3.13PM)

EOD:

5326 stood its ground. No intraday trades could be initiated despite tracking the waves correctly as very tight range was being played.

The chart below is indicative of things to come in next week.

I had finished the EOD 7.3.2012 in following manner:

An analysis of sw5 of (v) , from 5382-5171 can give us some clue.

By the labels shown above , one can argue that a breach of 5244 would confirm the end of wave 5382-5171 as its (iv) would get breached. But this (iv) can also be labelled as an Expanded Flat as shown below:

And then from around 5265 ,we may see a sharp move down to sub-5171.

Now lets examine the above probablity in detail.

While a=5184-5243.55=59.55 was a clear 3 wave form, was b=5243.55-5171.6 a 3 wave form?

If yes,then above labels are valid. If no,then I would call the downmove over at 5171.6

So pulled out 30 sec charts to find out how waves have fanned out from 5243.55 onwards:

First set of labels shown above were used for intra-day scalp on 7.3.12 but the Nifty moves from 5188.05 onwards did not justify any further counts,so following labels were also tried:

So by EOD 7.3.12, status was fluid and the opening moves on 9.3.12 only shall define the future wave pattern.

So what should be our guiding light?

The labels shown below support the probability of Nifty going below 5171 once again.

.png)

But once above165% of a(=5184-5243.55=59.55) i.e. 5171.6+98.25=5270, this probabilty would become invalid.

So a tick above 5170 should become our guiding light to declare that first set of 5 waves from 5629 downwards has indeed ended at 5171 and buy at dips for targets 5460-5530 is called for.

And till this tick above 5270 does not take place,probability of once again going below 5171 should be considered very much alive.

How have we opened?

Opening above 5270 means short term bottom found at 5171.

Now we shall retrace 5629-5171=458 by 50-61%

And this upmove is likely to be a 3 wave form.

11.00AM

Time to book profit in longs and wait for the dips to go long again.

And what the trendlines are saying:

A visit to sub-5300 is definitely due.

1.30 PM

2.00 PM

Now most likely to test day's high,before starting down for a deeper corrective.

BE READY FOR DEEPER CORRECTIVE.

Below 5320,short for a gain of 80 points. Stop loss at day's high.

3.00 PM

Short below 5326. SL 5343

5326 not breached as yet.(3.13PM)

EOD:

5326 stood its ground. No intraday trades could be initiated despite tracking the waves correctly as very tight range was being played.

The chart below is indicative of things to come in next week.

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

Thank you very much sir.

ReplyDeletevery good going guruji

ReplyDelete